Maguar acquires hsbcad with Goodwin's help

Goodwin advised Maguar Capital on financing their acquisition of hsbcad, a leading construction software firm

Global law firm Goodwin has successfully advised Maguar Capital, a German tech investor, on the financing of its acquisition of hsbcad, a prominent provider of software for offsite wood construction. This transaction was backed by funding from Cordet Capital Partners.

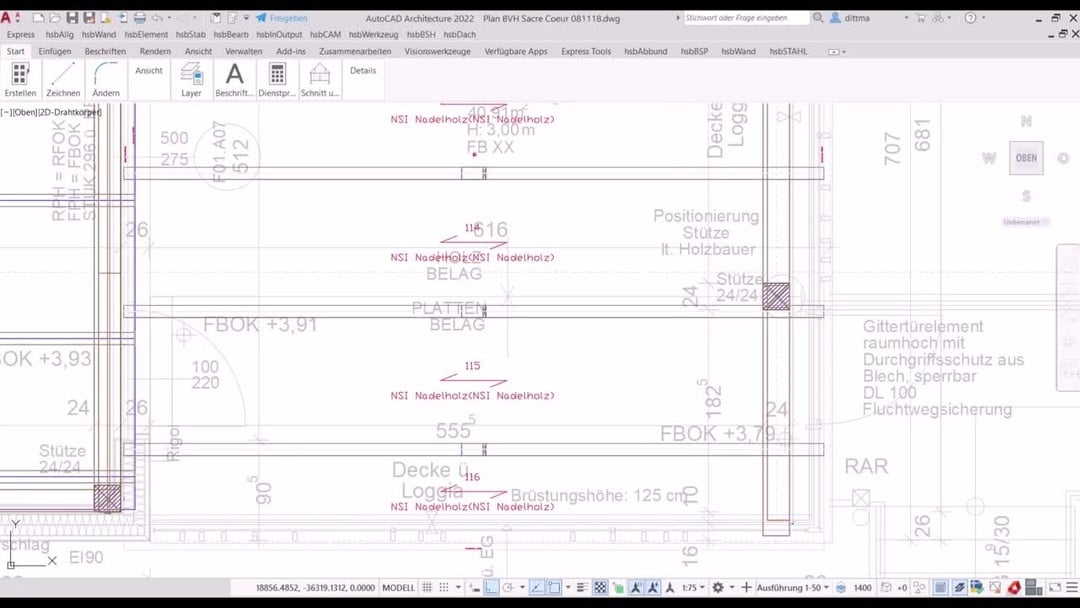

hsbcad, established in 1988, is a pioneer in offering advanced software solutions tailored to enhance the Design for Manufacture and Assembly (DfMA) workflow in the construction industry. Its software integrates with platforms like Autodesk’s Revit and AutoCAD, enabling clients worldwide to improve efficiency, reduce material waste, minimise errors, and meet project timelines effectively.

Maguar Capital, founded in 2019 and based in Munich, focuses on investing in small and medium-sized B2B software companies across the DACH and Benelux regions. The firm’s team, with over three decades of combined experience as software CEOs and extensive private equity expertise, provides strategic support to its portfolio companies.

Goodwin’s Munich partner Winfried M. Carli led the transaction team, with support from Frankfurt associate Marius Garnatz and colleagues across Munich, Frankfurt, and London, specialising in private equity, finance, and tax. The successful deal underscores Goodwin’s role in facilitating impactful investments in the software and technology sector.