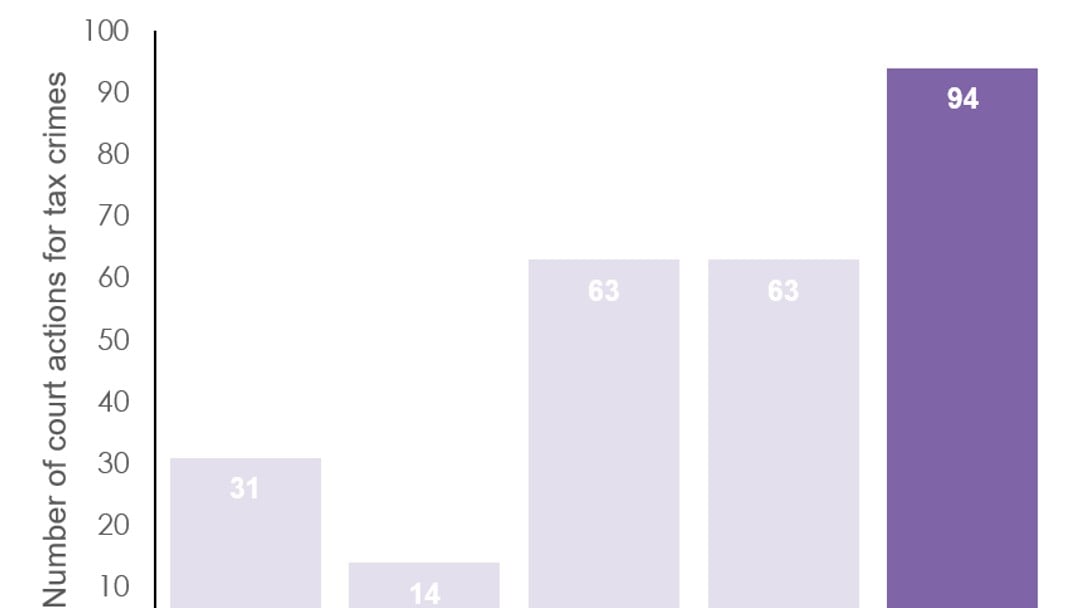

Criminal cases against tax fraud up 49% in past year – 94 cases last year

By Law News

Tax fraud cases in the UK rose 49%, reaching 94 in 2022/23, as HMRC intensifies crackdown

The number of criminal cases brought for tax fraud in the UK has surged by 49% in the last year, increasing from 63 proceedings in 2021/22 to 94 in 2022/23, according to multinational law firm Pinsent Masons. This rise reflects HMRC's intensified efforts to combat tax crime.

HMRC reserves criminal tax fraud charges for the most serious instances of tax evasion, typically involving deceit towards the tax authority or cases involving high-profile or influential individuals. The rise in criminal tax fraud cases is part of a broader effort by HMRC to clamp down on major tax evasion and fraud. Both the Conservative Party and the Labour Party have committed to intensifying efforts against tax evasion post-election.

In the past year, there have been 20 successful convictions for tax fraud. Pinsent Masons anticipates more successful prosecutions in the coming year due to the lengthy nature of these cases.

Steven Porter, Partner and Head of Tax Disputes and Investigations at Pinsent Masons, noted, “Criminal charges are the most powerful weapon in HMRC’s arsenal – and they’re a weapon that it’s now using much more often. The threat of a prison sentence has a strong deterrent factor to it.”

Steven Porter emphasised that HMRC opts for criminal cases only in severe situations, as they are costly and demanding. The rise in criminal proceedings demonstrates a firm crackdown on serious tax evasion and fraud. He advises taxpayers with significant unpaid tax to seek professional guidance to avoid criminal investigation, potentially negotiating for a civil settlement instead.

In the last year, HMRC initiated 1,091 civil investigations, known as ‘COP8’ and ‘COP9.’ These investigations can result in penalties up to 200% of the tax owed plus interest, particularly in cases of offshore tax evasion. However, civil investigations do not carry the risk of a prison sentence.

“A criminal investigation is something anyone who hasn’t paid tax properly should try to avoid,” Steven Porter stressed. “Even the biggest financial penalties are preferable to a prison term. It is possible for taxpayers to agree with HMRC that it will only undertake a civil investigation – so long as they are full and frank about anything they have done wrong. If they try to hide anything at all, HMRC can withdraw its agreement and pursue criminal charges against them.”